Still Waiting for the Retail Apocalypse?

How data, not intuition, is critical to winning in the post-pandemic retail marketplace.

The pandemic, in addition to upending our lives in general, generated enormous speculation around the state of brick-and-mortar retail in 2022 and beyond. The COVID shutdowns raised serious questions as to whether stores would survive at all, and if they did, whether retailers would invest in – or divest from – their physical networks.

The specter of a “Retail Apocalypse”, of course, precedes the pandemic. With mass store closings and the rise of the always-on, omnipresent, convenience of the digital channel, the industry has been haunted by rumors of its demise since the Great Recession.

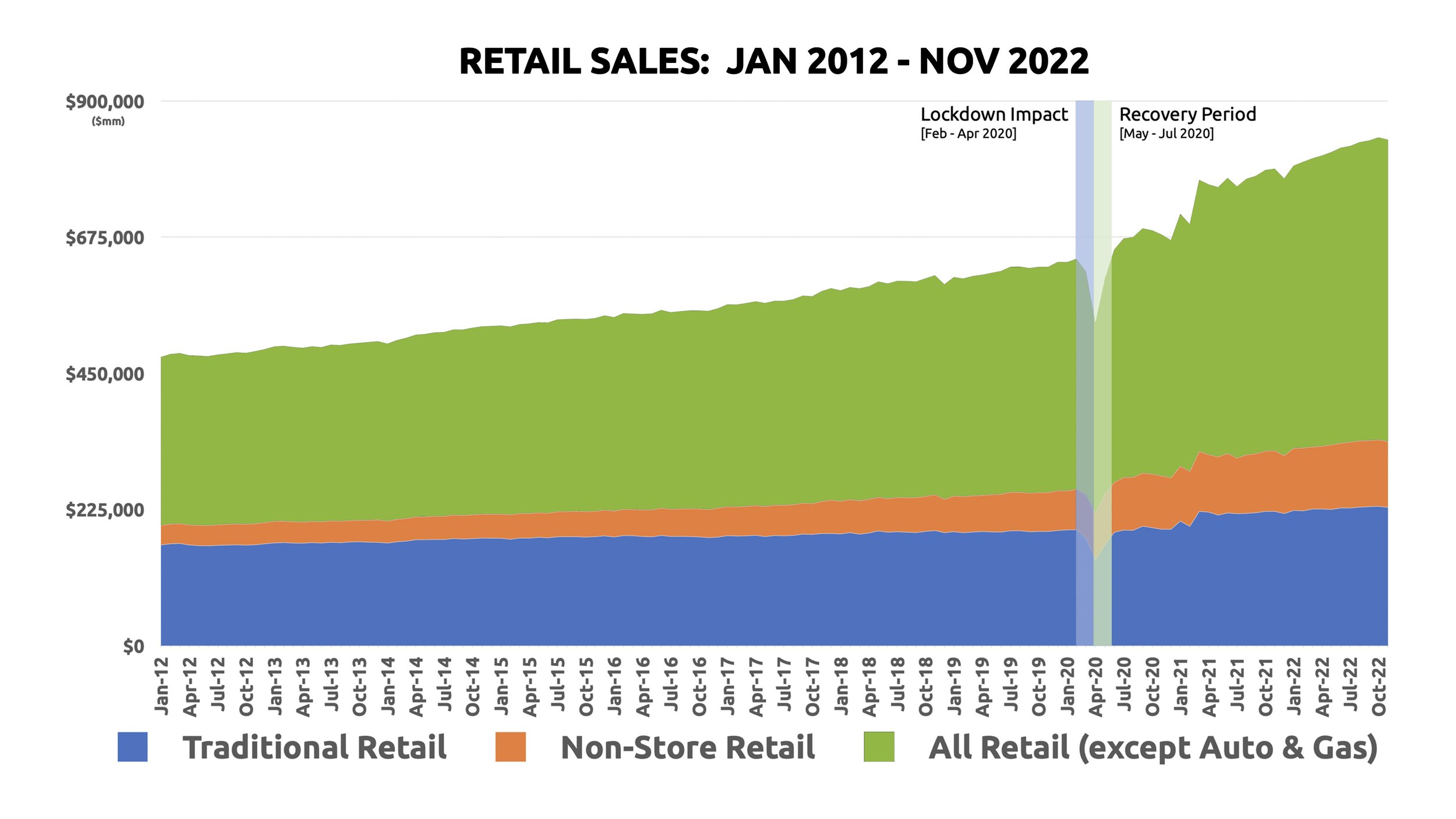

Yet the data tells another story. Both digital and physical retail sales over the past decade have continuously risen with just a 6-month brick-and-mortar dip during COVID lockdowns.

If both online and offline sales actually have increased over the past 10 years, why is there constant doom-and-gloom forecasts for physical retail? Two questions from pundits and customers alike are driving the perception that brick-and-mortar is on the brink of collapse:

The answers to these questions provide a framework for assessing current conditions and how analytics can help retailers determine the best strategy for investment in their store networks. Even if retail revenues overall aren’t in decline, brick-and-mortar is constantly evolving, and retailers must adapt to stay relevant. And to us at TerraStrat, data and analytics always provide the answers to survive and thrive in uncertain times.

Why are so many retail brands going bankrupt or closing stores?

Overbuilding

One cannot help but notice the growing number of derelict or declining malls. The novel, European flair of early malls thrilled American shoppers. Between 1970 and 2017 the number of malls tripled from 37,000 to 116,000. But their allure didn’t fuel this explosive growth. It was spawned by a little-known change to the tax code.

In 1954 congress allowed mall developers to accelerate depreciation from 15 to 5 years, incentivizing them to capture huge tax benefits, sell the property at a profit, and invest the proceeds in a new project. This not only swelled mall numbers, but also shrank the addressable consumer base and tenant revenue potential.

Retailers saddled with long-term leases in existing malls faced a dilemma: let competitors take prime spots in the new, swankier mall unchallenged, or sign a new lease and absorb the added staffing and occupancy cost. Unfortunately, many retailers who chose the latter strategy ended up with bloated, underperforming store networks. Thus, it’s not surprising that some culled their portfolios or even filed for bankruptcy.

Shifting Consumer Preferences

Recent studies of shopping preferences reveal that 56% of consumers now favor local, independent stores and locally sourced products, with 82% saying they’d spend more to support local businesses after the pandemic. For most, this preference stems from a belief in supporting the local economy and the perception that local merchants excel at delivering the products and personalized service customers are looking for.

By contrast, national chain stores have been cutting both wages and frontline staff numbers to bolster margins. Department and apparel stores, where trusted advice has traditionally been a core component of brand value, are losing ground to local counterparts due to declining service levels.

Isn’t online shopping crushing the brick-and-mortar channel?

Perception v. Behavior

Online retail was supposed to be a low-cost distribution channel with infinite reach, that could precisely target high-potential customers without investing in or staffing physical stores, and in 2022 it’s not uncommon to hear friends or colleagues say, "I buy almost everything online”.

While this feels logical, it simply hasn’t been the case. Digital stores generally deliver much lower margins and, as of mid-2022, only account for 20% of retail sales. To be fair, that’s more than double what consumers spent via digital channels 10 years ago, which is probably why people perceive their shopping habits have changed so radically.

Bad Assumptions

Business cases advocating online channels often underestimated the cost of ramping up technology, operations, supply chain, and customer support that enable the digital store. Additionally, customer acquisition costs, originally a bargain, have skyrocketed. However, returns have had the most devastating impact on the digital dream. Processing returns reduces an item’s value, on average, by 65% due to round-trip shipping/handling and inspecting, repackaging, and reselling the item at a discount.

Yet lower margins on their own are not a barrier to success. In fact, the most successful online retailers like Amazon, Alibaba, Walmart, and eBay generate huge revenues at very low margins. In fact, 9 of 10 firms that account for 61% of US online retail sales employ low-margin, long-tail models and show no inclination to change.

Thus, for the average retailer, dreams of vastly expanding sales and growing margins online led to disappointment. Many digital-first retailers like Amazon, Apple, Warby Parker, Bonobos, and Peloton even opened brick-and-mortar stores to accrue more revenue and brand loyalty than was possible online.

Summary

The demise of brick-and-mortar stores is unlikely, despite constantly evolving online experiences and the shock of COVID lockdowns. The culling of retail stores was a course correction away from ill-conceived, explosive development and digital channels never became the massive profit engines we’d hoped they would. How should retailers adjust their roadmaps going forward? For us at TerraStrat, data is the most reliable beacon in stormy uncertain conditions. Read our follow-up white paper on how we can help you place your physical stores in optimal locations to best connect customers to your value.

1 Malcolm Gladwell’s article “The Terrazzo Jungle” in the March 15, 2004 Issue of The New Yorker Magazine, provides an in depth review of the impact of this tax code change on mall development.

2 A study by Intuit details the local shopping trend that is likely to persist in the post-pandemic world.

3 Insider has reported that Meta’s cost per thousand (CPM) increased by 61% YoY, reaching an average CPM of USD $17.60. Meanwhile, TikTok’s CPM increased by a huge 185% YoY, peaking at an average CPM of USD $9.40. Google also saw programmatic display CPMs increase by 75% YOY, while search ad cost-per-click s (CPCs) were up by 14% YOY. Amazon has also seen notable CPC growth for their sponsored products offering, up 14% YOY

4 A National Retail Federation study revealed that overall returns jumped from 10.6% to 16.6% in 2021 and, in the same year Chain Store Age reported that the cost of processing returns equaled 66% of a typical item’s value. Retail Touchpoints reports that 30% of online purchases are returned vs. a 9% return rate for in-store purchases. Other studies by firms like Alvarez and Marshal, McKinsey and the Retail Industry Leaders Association in 2021 and 2022 confirm lower margins online.

5 Retail Dive: “The omnichannel age is here — and it’s expensive” April 5,2021

6 These firms are largely resellers who have made enormous investments in technology, logistics and inventory management for decades.

7 Long tail models, first described by The Economist writer and author Chris Anderson, combine a “head” of high demand products with a very large variety of niche products that are in much less demand but hard to find elsewhere. Firms like WalMart and Sears have leveraged this model very successfully for over a century to draw traffic away from specialty retailers.

8 A March 2022 report in Big Technology revealed that nearly every digitally native, D2C brand with a market cap greater than $800mm was facing “revenue contraction, shrinking margins, runaway losses, or a combination of all three”