Do Branch Relocations Work?

A portion of new bank branch builds involve the simultaneous closing of a nearby branch. In these cases, the FDIC considers the situation a relocation. They represent about one of every six new branches being built today. Typically, the banks who invest in relocations have found that the area immediately around the old branch has changed and nearby newer developments may be more appealing to new and existing customers. Those banks are often hoping for faster deposit growth. Do they get it?

The latest FDIC Share of Deposits database was recently released. My followers know that the release invariably leads to a series of articles on the health of bank branches. So far, I’ve written about ways to interpret and use the database release, new branch de novo’s, and instore branches. In this article, I’ll take a look at branch relocations. Branch relocations are situations where one branch (or sometimes 2 or 3) is closed into one new branch nearby. They differ from traditional branch closures in that the deposits are redomiciled into a new branch rather than an existing branch. You can find relocations in the FDIC database by identifying a “new” branch (i.e., established date within 12 months of the report date) that has historical deposit levels.

In the latest FDIC report, I identified 206 relocations fitting that description. All but one of these relocations were traditional branches (branch service type 11s) with only one relocation of an instore supermarket branch (branch service type 12). For the rest of this article, I will be examining the traditional branches.

Given every bank reports differently and some don’t exactly follow all the rules, there may be more relocations in this year’s release.

First, who is investing new capital into relocating existing branches?

Seemingly, everyone. In the last 12 month reporting period, 158 banks relocated a branch with most doing just 1. Truist leads the pack at 21 relocations, likely cleanup from the 2019 merger of BB&T and SunTrust. Only one other bank, Bancorpsouth, had double digit relocations.

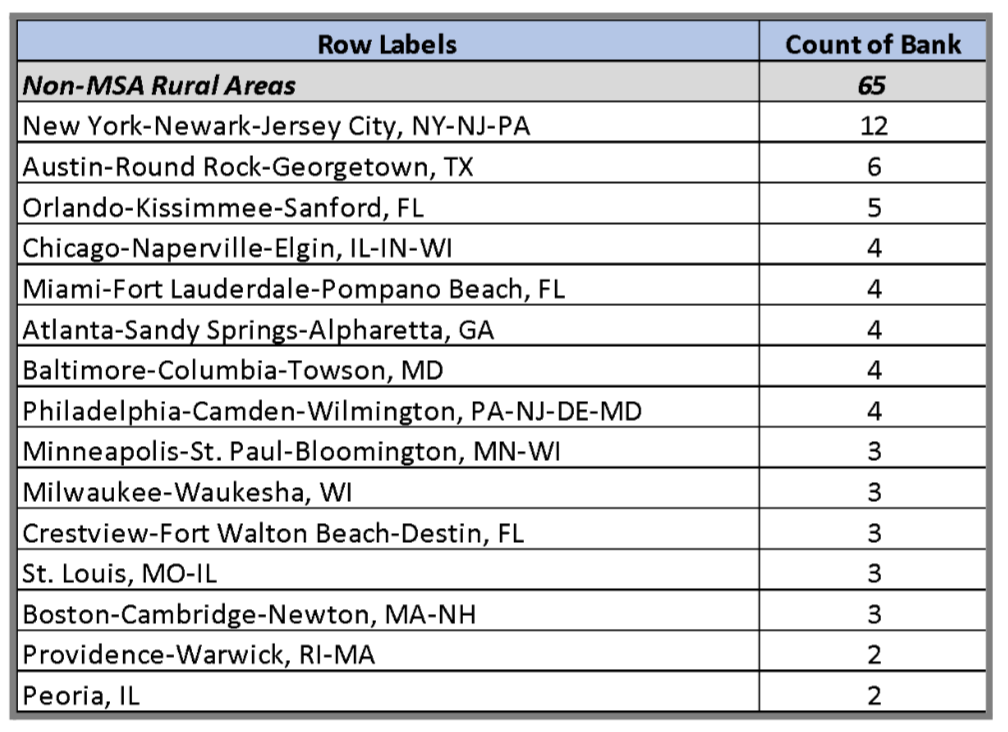

The second question is where are relocations occurring?

The most stunning fact is that 1/3 of all branch relocations are in rural areas. Rural branches generally have smaller branch deposit bases due to a lack of demand. These branches grow more slowly than those in more urbanized communities. This generally weak performance is due to the lack of population and to low population growth. Makes you wonder what these banks are thinking. The rest of the top relocation geographies are mostly the largest or fastest growing metro areas across the country.

The third question is how have the relocations performed in the short-term?

It seems the relocations had a somewhat negative impact on deposit levels. Note: Branch deposits capped at $500MM to minimize impact of corporate deposits as in other analyses.

Prior to the relocation, the branches averaged $122 million in deposits, which is a surprisingly high level of deposits (i.e., higher than national average for all branches). In the years leading up to the relocation, deposit growth was slightly less than the national average, but in 2019-2020 growth was only half the national rate. Perhaps the slower growth was the rationale for making the capital investment, following the logic that it’s a valuable, profitable branch, but it’s failing to get the expected growth.

In the year following the relocation, deposits declined by nearly 4%, compared to the industry average of 12.5% deposit growth, suggesting some customer runoff occurred due to the disruption. In my experience, some customer loss is expected but usually offset by faster organic growth.

One more thing. Does that trend of deposit decline vary between urban and rural areas? About 1/3 of relocations occurred outside of metro areas. Apparently, banks were more successful in repositioning these branches, as evidenced by continued deposit growth when compared to the metro area relocations.

Just speculating, but this may be due to the nature of rural areas with smaller communities where it’s easier to navigate from one part of town to another. Reinforces the point that the new site still needs to be convenient to users of the old branch site.

Implications

The implications for your bank or credit union are clear.

Relocations should be targeted in good markets where your branch might not be well positioned to capture its fair share of growth. Relocations won’t help you if the market conditions aren’t right for growth.

Relocations need to be planned carefully as you are going to invest $2-3 million in building a new branch. You need to ensure that your customers understand the move and won’t be too inconvenienced.

Even with a good new site, consider placing a leave-behind ATM nearer the old site to minimize disruption, especially if the relocation is more than a mile away from the old site.

Consider the size of facility you need at the new site and the staffing levels, so you don’t downsize too much causing longer wait times.

Note: The data provided by the FDIC may not have included all relocations as it’s up to bank members to report their actions accurately. Some may have reported the move as a closure and a de novo, and not linked the historic deposits to the new site.